– Commercial International Bank – Egypt (CIB), Banque Misr, Bank of Alexandria, National Bank of Egypt, Attijariwafa Bank Egypt, Crédit Agricole Egypt, Emirates NBD Egypt and HSBC Bank Egypt announce the successful signing of a Syndicated Facility for one of Egypt’s largest and most innovative telecommunications operators, Orange Egypt for Telecommunications.

The transaction, valued at EGP 8 billion, marks a significant milestone in the company’s strategic financial planning and growth agenda.

CIB, being the Initial Mandated Lead Arranger, Bookrunner and Facility Agent, managed the transaction and worked alongside a syndicate of top-tier banks including Banque Misr (BM), Alex Bank, National Bank of Egypt (NBE) who acted as Initial Mandated Lead Arrangers and Bookrunners, in addition to Attijariwafa Bank Egypt, Crédit Agricole Egypt, Emirates NBD Egypt and HSBC Egypt, who acted as Mandated Lead Arrangers, will collectively provide the financing over a tenor of 6 years. All eight participating banks have showcased their commitment to supporting Egypt’s telecom and digital infrastructure development.

The Syndicated Facility will be used to finance key capital expenditures, enabling the company to maintain its leadership in delivering cutting-edge telecom services to millions of customers nationwide.

The funding will support Orange Egypt’s continued investments in infrastructure, digital transformation and the rollout of next-generation services across Egypt.

The transaction proves the multinational firms’ interest in the local market and its trust to operate with local banks among its group of lenders.

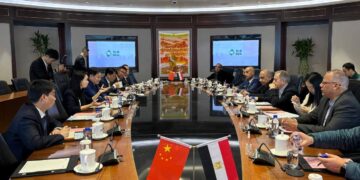

The signing ceremony was attended by Hesham Mahran, Orange’s CEO, Amr El-Ganainy, CIB’s Deputy CEO and Executive Board Member, Hisham Okasha, BM’s CEO, Mohamed El Etreby, NBE’s CEO, Antonio Bergalio, Alex Bank’s Deputy CEO, Amr El Shafei, ENBD’s CEO, Ahmed Darwish, Attijariwafa’s Assistant Managing Director, Ahmed Essam El Din, CAE’s Head of Corporate Banking and Ehab Eissa, HSBC’s Head of Global Network Banking.

Adsero – Ragy Soliman & Partners acted as the Lenders’ Legal Counsel and worked collaboratively to execute the transaction efficiently and successfully.

Commenting on the transaction, Amr El-Ganainy, Deputy CEO & Executive Board Member at CIB, stated “At CIB, we believe in building enduring partnerships that foster progress, as these projects play a direct role in driving economic growth and enhancing the competitiveness of the Egyptian economy”.

El-Ganainy explained that this transaction further reaffirms the strength and resilience of the Egyptian banking sector and its ability to provide long-term financing to support expansion and investment plans for major corporates, despite ongoing global economic challenges.

This, he noted, reflects a stable banking environment capable of attracting the confidence of multinational corporations. He emphasized that CIB’s role extends beyond providing financing to offering financial advisory services and building long-term strategic partnerships based on a deep understanding of clients’ needs and a clear vision for their future growth

El-Ganainy further highlighted that CIB places particular emphasis on supporting investments aimed at developing digital infrastructure, given its pivotal role in improving service quality, advancing financial inclusion, creating employment opportunities, and supporting the state’s efforts to implement Egypt’s Sustainable Development Vision and digital transformation agenda.

He concluded by reaffirming CIB’s ongoing commitment to supporting leading corporates with ambitious growth plans, expressing his confidence that this financing will significantly enhance the operational and competitive capabilities of Orange Egypt Telecommunications and deliver sustainable added value for all stakeholders.

Hisham Okasha, CEO of Banque Misr, emphasized that the Bank’s participation in this syndicated financing aligns with its comprehensive strategy to provide innovative and sustainable financing solutions.

These solutions are designed to meet customer needs and support vital economic sectors, thereby contributing to driving economic growth and achieving comprehensive development ,Okasha commended the fruitful, constructive cooperation between Banque Misr and all participating banks, which led to the successful conclusion of the financing.

He highlighted the pivotal role of the Egyptian banking sector in supporting the national economy, particularly in strategic sectors with direct impact, foremost among them the telecommunications sector ,He noted that Orange Egypt is a leading player in this vital sector, and that this syndicated financing will enable the company to achieve sustainable growth, enhance its competitiveness, and improve service quality in the Egyptian market. This supports technological advancement requirements and aligns with the state’s development plans, He reaffirmed that Banque Misr continues to act as a key catalyst for national and strategic development, driven by a firm belief in sustainability, continuous improvement, and the fostering of effective partnerships that help build a robust economy capable of withstanding future challenges.

Mohamed El Etreby, Chief Executive Officer of the National Bank of Egypt, stated that the medium-term syndicated facility amounting to EGP 8 billion, for Orange Egypt for Telecommunications, emphasizes the pivotal role played by the National Bank of Egypt—as one of the pioneers in the banking sector. He stressed that this financing reflects NBE’s strategic partnerships in support of the private-sector, particularly large multinational corporations operating in key industries.

Telecoms and IT represent a strategic pillar for achieving an all-inclusive digital and financial transformation ambition. El Etreby expressed his satisfaction with the effective cooperation between the eight banks, participating in this syndicated facility, and Orange Egypt for Telecommunications. He pointed out that the syndicated facility has been structured to have a six-year tenor, financing capital expenditures and enhancing the advanced services provided by the Company, particularly in light of the significant advancements in technology and AI.

El Etreby further affirmed that this financing enables Orange Egypt to make optimal use of liquidity and provides it with financial flexibility in managing its cash flows. This reflects the ability of the Egyptian banking sector to effectively contribute with comprehensive financing solutions that drive the development of services offered by major companies operating in strategic sectors to enhance their competitiveness in both local and global markets.

Paolo Vivona, Chief Executive Officer and Managing Director of ALEXBANK, stated: “ALEXBANK is proud of its partnership in the syndication for Orange as Initial Mandated Lead Arranger and Bookrunner, reaffirming its strategic commitment to financing sectors that are critical to Egypt’s economic development and to enabling digital transformation. ALEXBANK’s role reflects its strong confidence in the telecommunications sector, which plays a pivotal role in supporting sustainable economic growth, as well as in Orange Egypt as one of the market’s leading players. ALEXBANK remains firmly focused on acting as a trusted financial partner to leading corporates, creating sustainable value and long-term economic impact, in alignment with the Intesa Sanpaolo Group’s strategy.”

Mouawia Essekelli, CEO and Managing Director added: “Attijariwafa Bank Egypt is proud to support the growth of businesses across all sectors in Egypt, including the vital telecommunications industry. Our participation in this syndication reflects our ongoing commitment to empowering infrastructure projects in the Egyptian market. We value our longstanding partnership with Orange and reaffirm the bank’s full commitment to supporting its continued success.”

Amr El Shafei, CEO & Managing Director – Emirates NBD Egypt said that the bank’s financing for Orange Egypt reflects its continued focus on sustainable financing and strategic partnerships. He also stated that the financing will support Orange Egypt’s business expansion highlighting the company’s position as one of the most leading telecommunications operators in Egypt. El Shafei added that the transaction supports the growth of Egypt’s telecommunications sector and reflects the bank’s commitment to financing key sectors that contribute to economic growth and national development.

In that regard, Ahmed Essam, Head of Corporate Banking at Crédit Agricole Egypt, stated: “We are proud to participate in this landmark transaction, which underscores the strength of our strategic partnership with Orange. We are also pleased to collaborate with a distinguished group of banks in extending this financing to a trusted multinational partner. Our engagement in this transaction is fully aligned with Crédit Agricole Egypt’s strategic objective of encouraging economic development and fostering sustainable growth in Egypt.”

Ehab Eissa, HSBC Egypt Head of Global Network Banking added: “Through our Global Network, HSBC has supported Orange across more than 15 countries and for more than two decades, we have had a long-standing partnership with Orange Egypt. Acting as Mandated Lead Arranger in this syndicated facility reinforces our belief in the vital role that Orange and the telecom sector play in advancing Egypt’s digital development.”

Commenting on the transaction, Mohamed El-Sayed Abdel Moaty, Orange’s Chief Financial Officer, said: “This syndicated facility provides Orange Egypt with a robust and diversified funding platform to support our ongoing growth and capital investment plans. The strong participation from leading banks reflects confidence in our operating performance and strategic direction. This transaction enhances our financial flexibility and strengthens our capital structure, enabling us to efficiently fund ongoing and future capital investment programs. In particular, it will support the continued expansion and modernization of our network infrastructure, improve service quality, and accelerate the deployment of next-generation connectivity solutions across our markets.”

انت تقرأ هذا الموضوع في قسم English على موقعك المفضل البيان الاقتصادي نيوز.

كما يمكنم ايضا تصفح المزيد من الاقسام الهامة في موقعنا: